Why ERP Integrations Break at Scale (And How Native Functionality Prevents It)

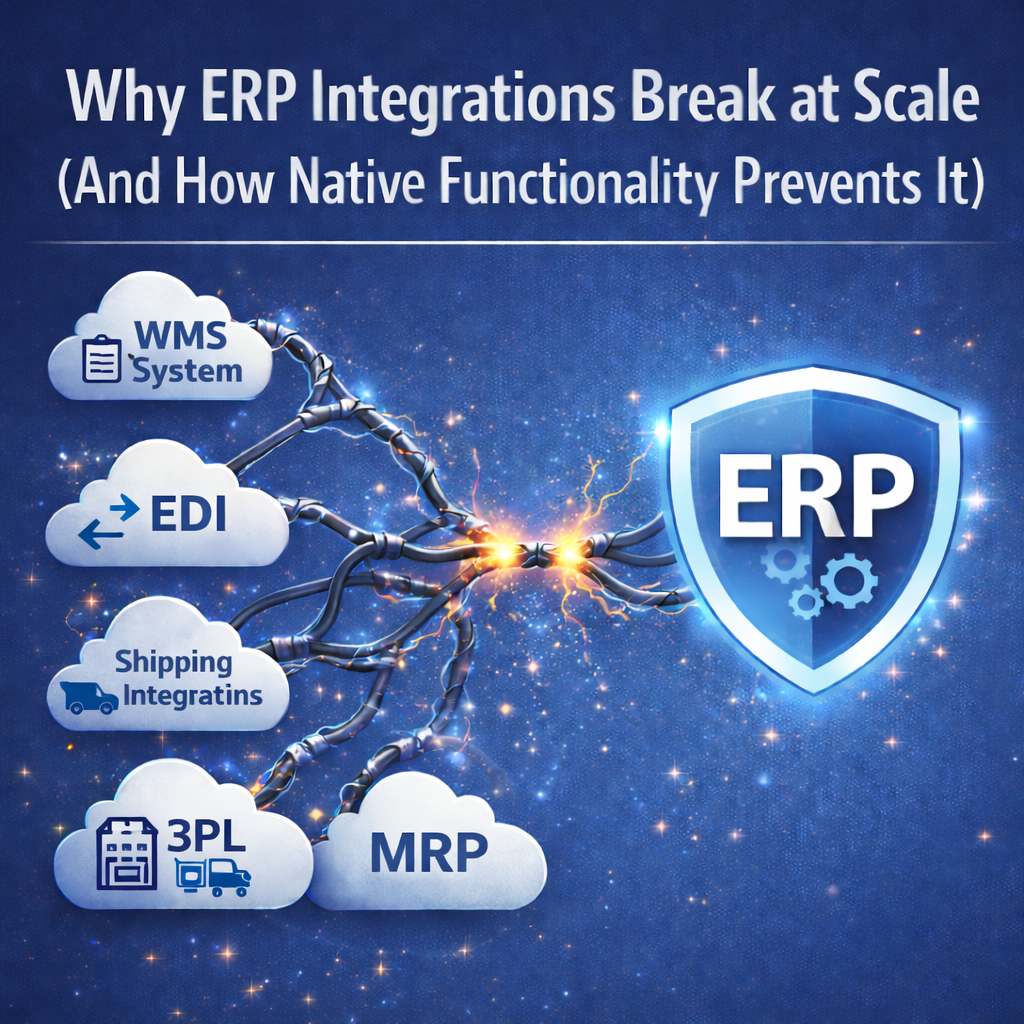

Your company just closed its biggest deal of the year—a national account that will double warehouse throughput. The celebration lasts exactly three days. That’s when your warehouse management system integration starts timing out during peak hours. Order confirmations delay by four hours instead of real-time. Your EDI processor can’t keep up with the transaction volume. And the custom middleware connecting your CRM, ERP, and shipping systems begins throwing errors that no one on your team fully understands.

This is the integration scaling crisis that catches distributors by surprise. The best-of-breed approach seemed perfectly logical: choose specialized tools for each function, then integrate them. It worked beautifully at $30 million in revenue. At $75 million, the cracks started showing. At $100 million, you’re spending more time managing integrations than improving operations.

The fundamental problem isn’t your IT team’s competence or your integration tools’ quality. It’s that architectural complexity increases exponentially, not linearly, as transaction volumes and data dependencies grow. And most distributors discover this reality only after the integration framework becomes mission-critical and impossibly fragile.

The Hidden Complexity Tax of Integration Architecture

The integration approach looks deceptively simple in architecture diagrams. Your ERP sits at the center, connected to your WMS, TMS, CRM, EDI gateway, e-commerce platform, shipping software, and accounting system. Clean lines between boxes suggest straightforward data flows. Reality proves far messier.

Integration points multiply faster than applications. With three systems, you manage three integration points. Add a fourth system and you’re managing six potential connections. Ten systems require managing forty-five integration relationships. The complexity isn’t additive—it’s factorial. Each new application doesn’t just need to connect to your ERP; it potentially needs awareness of data from every other system.

Data synchronization becomes a timing nightmare. When your e-commerce platform creates an order, the ERP must receive it, check inventory across your WMS, update pricing from your PIM system, validate the customer credit limit from your accounting software, and return confirmation to the website—all within seconds. A delay or failure at any point breaks the entire transaction flow. Your WMS shows available inventory that your ERP already allocated. Your CRM shows customer data that contradicts your accounting system. Version conflicts cascade across your infrastructure.

Error handling creates exponential debugging complexity. When an order fails, where’s the problem? Did the WMS reject the inventory allocation? Did the EDI translation error? Did the shipping system timeout? Did the CRM not update? Each integration point becomes a potential failure source, and tracing transaction flows across multiple systems with separate logging mechanisms turns troubleshooting into archeology. Your IT team spends hours reconstructing transaction histories from fragmented logs across disparate platforms.

Version dependencies create upgrade gridlock. Your ERP vendor releases an API update that improves performance. But your WMS integration relies on deprecated endpoints. Your shipping software expects the old data format. Your middleware needs reconfiguration. What should be a straightforward ERP upgrade becomes a six-month project coordinating changes across eight vendors, each pointing fingers when something breaks. Eventually, you stop upgrading entirely, accepting security vulnerabilities and missing features because the integration dependencies make change too risky.

Transaction volumes amplify architectural weaknesses. At low volumes, integration latency is invisible. Processing fifty orders daily, a three-second integration delay per order adds two minutes to total throughput. At five hundred orders daily, that same delay adds twenty-five minutes—but the cumulative impact is worse. Integration queues back up. Timeout thresholds trigger. Retry logic creates duplicate transactions. What worked perfectly at startup volumes fails catastrophically at scale.

The operational cost of this complexity isn’t just IT staff time—though companies typically dedicate 30-50% of technical resources to integration maintenance rather than value-adding projects. The cost includes delayed business decisions when reports reconciling data across systems take days to produce, lost sales when real-time inventory visibility proves impossible across integrated systems, customer service failures when representatives see conflicting information from different platforms, and strategic paralysis when evaluating new capabilities requires assessing integration impact across the entire stack.

Why Integration Issues Emerge at Predictable Growth Thresholds

Integration frameworks that work smoothly in early growth phases fail with remarkable consistency as companies reach specific scale thresholds. Understanding why reveals whether your architecture can support future growth or is approaching inevitable crisis.

The 10,000 order monthly threshold typically exposes real-time integration weaknesses. Below this volume, batch integration processes running every 15-30 minutes provide acceptable responsiveness. Above this threshold, the delays between system updates create operational friction. Customer service sees outdated inventory. Warehouse staff discover allocated stock was already promised. Finance reports don’t match operational reality. Companies respond by increasing batch frequency, which amplifies server load until performance degrades system-wide.

Multi-location operations create geometric complexity increases. Two warehouses require coordinating inventory visibility, transfer orders, and fulfillment routing across locations—manageable with careful integration design. Five locations create twenty-five potential stock transfer relationships and require real-time visibility into inventory across all sites for intelligent order promising. Integration latency that’s invisible in single-location operations becomes crippling when every order evaluation requires querying multiple systems across multiple locations.

Adding sales channels multiplies integration failure points. Distributing through your own e-commerce site, Amazon, eBay, and retail partners means every inventory change must propagate to five systems, every order must sync back to your ERP, and every fulfillment update must close the loop. When one channel experiences high volume, the integration bottleneck affects all channels. Black Friday demand from your e-commerce site delays B2B order processing because they share integration infrastructure.

International expansion introduces integration challenges that domestic operations never face. Different tax regulations require region-specific logic. Currency conversions need real-time exchange rates. Customs documentation demands data your domestic integrations never captured. Time zone differences mean batch processes designed for nightly runs must accommodate 24-hour operations. The integration complexity that worked for US-only distribution crumbles when extending to Canada, Mexico, and beyond.

Acquisition integration reveals whether your architecture can absorb complexity. Merging another distributor’s operations means integrating their systems—or forcing them onto yours. If your integration framework already strains under existing load, adding another company’s transaction volumes and system dependencies proves impossible. Companies with rigid integration architectures find acquisitions take 18-24 months to integrate fully. Those with flexible architectures complete integration in 3-6 months.

Peak season spikes test whether integrations handle variable load. Holiday shopping or seasonal demand might triple normal transaction volumes for 6-8 weeks annually. Integrations designed for average load fail under peak load. Queue depths exceed limits. Timeout thresholds trigger prematurely. Error rates spike. You discover scaling limitations only during the period when operational failures have maximum business impact.

The predictability of these thresholds should inform architecture decisions early, yet most companies address integration scalability only after problems emerge. By then, the migration path to more scalable architecture involves disentangling production systems while maintaining business continuity—a challenge that consumes massive resources and introduces significant risk.

The Real Cost of Integration Maintenance

The total cost of ownership for integration-heavy architectures vastly exceeds the obvious expenses. Beyond licensing fees for integration platforms and middleware, companies bear hidden costs that fundamentally limit operational agility and strategic flexibility.

Dedicated integration staff represent fixed overhead that scales with integration complexity rather than business value. Companies with best-of-breed approaches typically employ 1.5-2 full-time equivalents per major integration for monitoring, troubleshooting, and maintenance. A distributor running eight core integrations dedicates 12-16 FTEs to integration operations—staff who could otherwise drive business improvement initiatives. These roles require specialized technical skills, making recruitment expensive and turnover disruptive.

Vendor coordination overhead compounds when issues cross system boundaries. When orders fail to sync from e-commerce to ERP, is it the e-commerce platform’s API timing out, the integration middleware dropping transactions, the ERP refusing invalid data, or the network introducing latency? Each vendor points to others. Resolution requires coordinated troubleshooting calls involving multiple vendors, internal IT, and often external consultants. Issues that should resolve in hours extend to days while finger-pointing continues.

Emergency firefighting disrupts strategic projects. IT roadmaps envision implementing new capabilities—mobile warehouse apps, customer self-service portals, advanced analytics. Reality involves responding to integration failures that threaten current operations. The strategic project backlog grows while integration maintenance consumes available capacity. Companies report 40-60% of planned IT initiatives deferred or cancelled due to integration maintenance demands.

Data quality deteriorates when no single system serves as source of truth. Customer addresses exist in your CRM, ERP, and shipping system—which version is correct? Item descriptions differ between your PIM, ERP, and e-commerce platform. Pricing exists in multiple systems with synchronization delays. Gradually, data quality erodes until no one trusts any system completely. Business decisions rely on manual reconciliation across systems rather than operational reports.

Compliance and audit complexity increases when transaction flows span multiple systems. Financial audits require tracing revenue recognition across your e-commerce platform, ERP, and accounting system. Inventory audits must reconcile physical counts with records spread across your WMS and ERP. When integrations transform data, audit trails break. Demonstrating controls for SOC 2 compliance or preparing for acquisition due diligence requires documenting integration flows that only a few technical staff fully understand.

The opportunity cost of architectural inflexibility exceeds direct expenses. Market opportunities requiring rapid capability deployment—launching new sales channels, entering new geographic markets, adding product lines—become multi-quarter integration projects rather than quick wins. Competitors running unified platforms respond to market changes in weeks while you spend months coordinating integration updates across vendors.

A mid-sized distributor operating integrated best-of-breed architecture typically spends $400K-600K annually on integration-specific costs: middleware licensing, integration platform fees, dedicated staff, vendor support contracts, and consultant fees. The hidden costs—delayed projects, lost business opportunities, operational inefficiency from data inconsistency, and strategic paralysis from architectural complexity—often exceed direct expenses by 2-3x, though these costs rarely appear in TCO analyses that justify best-of-breed approaches.

How Native Functionality Eliminates Integration Complexity

Unified ERP platforms with native functionality fundamentally differ from integrated best-of-breed approaches in ways that become more valuable as operations scale. The architectural advantages compound over time rather than creating exponential complexity.

Single database architecture means all functional areas—inventory management, order processing, purchasing, accounting, CRM—access the same data in real-time. When a warehouse operator adjusts inventory, customer service immediately sees the updated availability. When sales enters an order, purchasing instantly sees demand impact on reorder points. There’s no synchronization delay because there’s nothing to synchronize. The data exists once, in one location, with one version of truth.

Unified business logic eliminates translation layers. In integrated architectures, each system has its own business rules, data models, and processing logic. Middleware must translate between these worldviews—mapping customer IDs, converting date formats, transforming transaction types. Each translation introduces potential errors and latency. Native functionality processes transactions once using consistent business logic. Customer credit checks, inventory allocation, pricing determination, and order promising all operate on the same data with the same rules.

Transaction atomicity ensures data consistency. When a customer places an order in a native system, the platform atomically checks inventory, allocates stock, updates availability, reserves shipping capacity, and confirms the order. Either the entire transaction succeeds or it fails cleanly—no partial updates requiring reconciliation. Integrated systems can’t guarantee atomicity across system boundaries, creating scenarios where inventory decrements in the WMS but order confirmation fails in the ERP, requiring manual intervention.

Consistent user experience accelerates training and adoption. Operators moving from inventory management to order processing to purchasing use the same interface conventions, navigation patterns, and interaction models. Integrated best-of-breed architectures force users to learn completely different interfaces for each functional area. The cognitive load of context-switching between disparate systems reduces productivity and increases error rates.

Simplified upgrades become routine rather than projects. When all functionality exists within a single platform, vendor updates test against the complete system rather than hoping API stability maintains backward compatibility. Cloud-native unified platforms typically update quarterly with zero downtime and no integration reconfiguration. Best-of-breed architectures might delay updates for years to avoid integration disruption.

Holistic analytics provide actual business intelligence. In native systems, reports span all operational areas because the data resides in unified structures. Analyzing customer profitability considers order frequency, average order value, product mix, freight costs, returns, and payment terms—all accessible in single queries. Integrated architectures require extracting data from multiple systems into data warehouses, then hoping the transformation logic correctly aligns the different data models. Report generation that takes seconds in unified systems requires overnight ETL processes in integrated architectures.

Rapid capability deployment becomes feasible when there’s no integration impact to assess. Adding mobile warehouse functionality, implementing customer portals, or enabling EDI trading partners involves configuring native features rather than specifying integration requirements, developing middleware code, testing data flows, and coordinating multi-vendor implementations. Time-to-value for new capabilities shrinks from months to weeks.

The performance difference becomes stark at scale. Companies processing 50,000+ orders monthly on native platforms report sub-second order confirmation, real-time inventory visibility across dozens of locations, and instant reporting across all operational dimensions. Similar companies on integrated architectures report 5-15 minute order processing cycles, inventory sync delays of 10-30 minutes, and overnight batch processes for comprehensive reporting.

The Myth of Best-of-Breed Specialization

The primary argument favoring integrated best-of-breed architectures claims specialized applications outperform unified platforms in their respective domains. For distribution operations, this reasoning proves increasingly questionable as cloud-native unified platforms mature.

The specialization advantage erodes when vertical platforms address specific industry needs. A generic warehouse management system might offer more features than ERP-native warehouse management in general. But a distribution-focused ERP platform designs its warehouse functionality specifically for distribution workflows—directed putaway for received goods, wave-based picking, zone management, and lot tracking. The relevant comparison isn’t “best WMS ever built” versus “ERP warehouse features as afterthought”—it’s “specialized distribution ERP with native warehouse management” versus “generic WMS requiring extensive configuration for distribution.”

Feature richness becomes irrelevant when 80% of capabilities go unused. Best-of-breed WMS vendors tout hundreds of configuration options and advanced capabilities. Most distributors use a fraction of available functionality. The unused features don’t create value—they create configuration complexity, training overhead, and upgrade challenges. Native platform features designed for common distribution needs often prove more valuable than extensive but overly complex specialized tools.

Integration limitations negate specialization benefits. Your best-of-breed WMS might have sophisticated labor management features—but if workforce productivity data doesn’t sync to your ERP for costing analysis, the value remains siloed. Your advanced CRM might provide detailed sales pipeline analytics—but if opportunity data doesn’t inform demand planning in your ERP, forecasting remains disconnected from market signals. The integration gap between specialized systems often eliminates the advantages their specialization theoretically provides.

Cloud-native architecture changes the equation entirely. Legacy ERP platforms with bolt-on modules couldn’t match specialized applications because the core architecture limited what was possible. Modern cloud-native unified platforms build functionality on current technology stacks, continuous delivery models, and user experience standards that rival standalone applications. The gap between “specialized tool” and “unified platform native feature” has narrowed dramatically.

The total experience matters more than individual features. A specialized WMS might have slightly more sophisticated wave optimization algorithms than native ERP warehouse management. But if the specialized tool requires separate login, different interface conventions, duplicate master data management, and integration delays propagating changes, the operational friction exceeds the algorithmic advantage. Users prefer slightly less sophisticated features in consistent, reliable systems over marginally better features in disjointed architectures.

Rapid innovation in unified platforms challenges the assumption that specialized vendors maintain permanent advantages. Cloud-native unified platforms release updates quarterly, continuously adding capabilities based on customer needs across their entire user base. Specialized tools update on slower cycles and lack context about how their domain integrates with broader operational needs. The innovation cycle now favors platforms with comprehensive operational visibility over point solutions.

The strategic question isn’t “what’s the most advanced warehouse system ever built” but “what architecture gives us the warehouse capabilities we actually need, integrated seamlessly with order management, inventory optimization, and financial operations, without creating technical debt that limits our future agility?” Increasingly, that answer is native functionality in distribution-specific unified platforms.

Real-World Integration Breaking Points

The theoretical problems with integration architectures become concrete operational crises at predictable moments in company growth. Recognizing these patterns helps distributors anticipate issues before they become business-threatening.

The acquisition integration crisis hits 12-18 months after closing the deal. The acquired company runs different systems—naturally, they were independent until acquisition. Leadership expects operational synergies: combined purchasing power, shared inventory across locations, consolidated customer management. But your integration framework can’t absorb their transaction volumes without performance degradation. The choice becomes forcing them onto your strained infrastructure immediately or maintaining duplicate systems indefinitely. Either path proves expensive and disruptive.

The peak season collapse occurs during the period when operational stability matters most. Your integration architecture handles average loads adequately—2,000 orders daily process smoothly. Holiday season jumps to 5,000 orders daily. Integration queues overflow. Timeout errors cascade. Your team discovers the hard way that the system doesn’t scale linearly. Revenue-critical orders delay while IT scrambles to increase queue sizes, adjust timeout thresholds, and add emergency server capacity. Next year’s planning involves either accepting the same risk or massive infrastructure investment.

The multi-channel expansion failure emerges when your third or fourth sales channel goes live. One e-commerce site and traditional B2B sales worked fine. Adding Amazon, Walmart Marketplace, and eBay creates inventory synchronization nightmares. Stock sells on Amazon while your website is still showing availability because the integration batch process runs every 15 minutes. Overselling generates customer complaints and marketplace penalties. You implement more frequent synchronization, which degrades overall system performance.

The international expansion bottleneck appears when entering the second foreign market. Opening Canadian operations required integration customization for currency, tax, and compliance differences. Extending to Mexico reveals that the integration framework can’t handle multiple foreign subsidiaries with different requirements. Every new market requires custom integration development. The technical team that should be enabling growth becomes the constraint preventing it.

The real-time requirement crisis hits when customer expectations change faster than architecture can adapt. B2B buyers increasingly expect consumer e-commerce experiences—instant inventory visibility, accurate delivery promises, immediate order confirmation. Your batch integration architecture can’t provide real-time experiences. Building real-time integration capability requires replacing the entire integration framework while maintaining current operations—a multi-year project with substantial risk.

The talent continuity problem surfaces when key integration personnel leave. The custom middleware connecting your systems exists primarily in the institutional knowledge of the developers who built it. Documentation is incomplete. Comments are sparse. When those people move on, new staff face months learning the integration architecture before they can maintain it effectively. One complex integration might represent 40,000 lines of custom code that three people on earth fully understand—and two of them don’t work for you anymore.

The security and compliance incident emerges when auditors question your data flows. Financial close requires reconciling revenue across your e-commerce platform, ERP, and accounting system. The integration transformations that occur make audit trails unclear. Preparing for SOC 2 compliance reveals that you can’t adequately demonstrate controls over data integrity when transaction flows span multiple systems with transformations in between. The integration architecture that enabled rapid growth becomes a compliance liability.

Each crisis follows similar patterns: what worked at smaller scale fails at larger scale, integration complexity makes rapid fixes impossible, and companies discover their architecture constrains rather than enables growth. The consistent thread is that integration-heavy architectures create brittle scaling limitations that only become apparent when business needs change—typically at the worst possible time.

The Cloud-Native Architecture Advantage

Modern cloud-native ERP platforms fundamentally differ from both legacy unified systems and integrated best-of-breed approaches in ways that directly address scalability challenges. Understanding these architectural differences clarifies why native functionality increasingly outperforms integration-heavy alternatives.

Elastic infrastructure automatically scales compute and storage resources to match demand. When transaction volumes spike during peak season, cloud-native platforms provision additional capacity transparently. When volumes return to normal, infrastructure scales back down. This elasticity is impossible in integrated architectures where each component system has independent scaling characteristics and constraints. Your ERP might scale beautifully, but if your WMS integration chokes under load, the entire system bottlenecks.

API-first architecture means even native functionality operates through well-defined interfaces, making external integrations—when truly necessary—first-class capabilities rather than afterthoughts. The same APIs that connect internal modules support external systems, ensuring consistent behavior and performance. Legacy platforms where integration capabilities were bolted onto monolithic cores can’t match the performance and reliability of API-first designs.

Microservices design allows independent scaling of individual functional areas within the unified platform. If order processing becomes the bottleneck, cloud-native architecture scales order processing capacity without requiring proportional scaling of inventory management or accounting functions. This granular scalability provides performance characteristics that match specialized systems while maintaining the integration benefits of unified platforms.

Continuous deployment enables rapid feature delivery without disrupting integrations. Cloud-native platforms typically update weekly or bi-weekly with zero downtime and no customer action required. New capabilities arrive continuously rather than in disruptive annual upgrade cycles. Best-of-breed architectures can’t match this pace because each component system updates on independent schedules, creating constant integration maintenance.

Unified data models designed for distribution-specific workflows eliminate the transformation complexity that plagues generic systems. When inventory management, order processing, purchasing, and accounting all operate on data structures designed specifically for distribution, the semantic gaps requiring translation in integrated systems simply don’t exist. The platform natively understands concepts like lot tracking, serial numbers, unit-of-measure conversions, and multi-location inventory that generic systems must accommodate through customization.

Real-time analytics become architecturally native rather than requiring data warehouse extracts. When all data exists in unified structures, dashboards and reports query operational systems directly without ETL delays. Business intelligence isn’t a separate system synchronized overnight—it’s a real-time view into actual operations. Decision-makers see current state rather than yesterday’s batch extract.

Built-in mobile capabilities provide native experiences rather than requiring separate mobile middleware. Cloud-native platforms typically include mobile SDKs, responsive interfaces, and offline-capable designs as core features. Warehouse staff, sales representatives, and delivery drivers access the same underlying platform through mobile-optimized interfaces that maintain complete integration with office-based operations.

The compound effect of these architectural advantages becomes more pronounced as operations scale. At $20 million revenue, the difference between cloud-native unified platforms and well-designed integrated architectures might be modest. At $200 million revenue, the cloud-native platform provides capabilities that integrated architectures simply cannot deliver at any cost: true real-time visibility across all operations, instant deployment of new features, elastic scaling through demand spikes, and unified analytics spanning all business dimensions.

Making the Architecture Decision: Integration vs. Native

Distribution companies face the integration-versus-native question at multiple points: initial ERP selection, scaling existing operations, acquisition integration, and international expansion. Making informed decisions requires understanding not just current needs but architectural implications for future growth.

Assess current integration burden honestly. How much time does IT spend maintaining integrations versus developing new capabilities? When systems fail, how long does troubleshooting take? How often do integration issues delay business initiatives? Companies where integration maintenance consumes 30%+ of IT capacity and integration troubleshooting regularly extends beyond 4 hours have architectures that constrain rather than enable business growth.

Evaluate true total cost of ownership including hidden costs. Beyond obvious licensing and implementation expenses, account for integration platform costs, dedicated integration staff, vendor coordination overhead, delayed strategic initiatives, data quality issues requiring manual reconciliation, and opportunity costs from architectural inflexibility. TCO models that exclude these factors systematically underestimate integration-heavy architecture costs by 50-100%.

Consider growth trajectory and likely scaling demands. Companies growing 20%+ annually will hit integration scaling thresholds within 3-5 years regardless of current comfort with existing architecture. Acquisition strategies, international expansion plans, and new sales channel initiatives all amplify integration complexity. The architecture decision isn’t about supporting current state—it’s about enabling planned growth without requiring complete replacement in three years.

Examine native platform capabilities in distribution-specific contexts. The relevant comparison isn’t generic ERP warehouse features versus specialized WMS—it’s distribution-focused cloud-native platform capabilities versus best-of-breed tools. Many modern unified platforms designed specifically for distribution provide native functionality that meets or exceeds specialized tool capabilities for typical distributor needs. Feature comparison must account for integration costs and operational friction in best-of-breed scenarios.

Test architectural flexibility through scenario planning. How would your current architecture handle doubling transaction volumes? Adding five new warehouse locations? Integrating an acquired company? Launching new sales channels? Expanding internationally? If these scenarios require 6-12 month projects, massive integration development, or are simply infeasible, your architecture limits strategic options. Unified platforms should accommodate these changes through configuration rather than integration development.

Prioritize actual usage over theoretical capabilities. Best-of-breed vendors tout feature richness that sounds compelling in demonstrations. But which capabilities will you actually implement and use? Complex configuration options might offer flexibility you’ll never need while creating adoption barriers and training overhead. Native platform features designed for common distribution workflows often deliver more practical value than extensive but underutilized specialized tools.

Value operational continuity and business agility appropriately. Integration projects that require months of coordination across multiple vendors, custom development, and careful scheduling to minimize business disruption create hidden drag on company agility. The ability to rapidly deploy new capabilities, respond to market changes, and pursue growth opportunities has strategic value that’s difficult to quantify but ultimately determines competitive position.

Examine vendor track records for continuous innovation. Cloud-native platforms releasing quarterly updates demonstrate commitment to ongoing improvement and respond rapidly to customer needs. Specialized tools updating annually or less frequently may fall behind market requirements. The integration approach assumes all vendors maintain pace with innovation—history shows this rarely occurs. Unified platforms can accelerate innovation across all functional areas simultaneously.

The decision framework should emphasize growth enablement over current state optimization. The architecture that handles today’s operations adequately might create insurmountable scaling barriers within 3-5 years. Choosing native functionality in distribution-specific unified platforms provides architectural flexibility that compounds in value as operations scale.

The Migration Path from Integration Hell to Native Functionality

Companies trapped in integration complexity face daunting prospects when considering architectural change. The migration path from integrated best-of-breed to native unified platforms requires careful planning but delivers transformational benefits that justify the effort.

Phase migration strategies minimize disruption while providing incremental value. Rather than big-bang replacement of all systems simultaneously, modern cloud platforms support phased approaches: start with core order management and inventory, prove value and stability, then migrate warehouse operations, add customer portal capabilities, implement mobile features, and finally deprecate legacy systems. Each phase delivers concrete benefits while building organizational confidence in the new platform.

Parallel operation windows during critical migration periods provide fallback options. Running new and old systems simultaneously for 30-90 days during initial modules allows verifying data accuracy, confirming business logic, and training users while maintaining operational continuity. The cost of temporary parallel operation proves minimal compared to risk reduction it provides.

Data migration tools and services provided by modern platforms dramatically simplify historically painful processes. Cloud-native vendors typically offer automated data extraction from common legacy systems, transformation services that clean and normalize data, and validation tools that confirm migration accuracy. What once required armies of consultants and custom ETL development now completes in weeks with platform-native tooling.

Integration bridges during transition periods connect legacy systems to new platforms where immediate full migration proves impractical. Your new ERP might handle order processing and inventory while temporarily integrating with legacy accounting until fiscal year-end. These temporary integrations differ fundamentally from permanent best-of-breed architecture—they’re explicitly designed as transition mechanisms with clear deprecation timelines.

Training and change management become simpler with unified platforms than with integrated architectures. Rather than teaching staff to navigate five different interfaces with completely different conventions, training covers one consistent platform. Users learn once and apply knowledge across all functional areas. New employees become productive faster. The total training burden often drops by 40-50% compared to best-of-breed environments.

Performance validation should focus on peak scenarios rather than average loads. Migration success isn’t about matching current performance under normal conditions—any competent platform does that. Validate that the new system handles peak season volumes, supports planned growth, processes real-time transactions at scale, and provides analytic capabilities across all operations. These are the scenarios where integrated architectures fail and native platforms prove their value.

Vendor implementation support varies dramatically in quality. The best platform vendors provide dedicated implementation teams, proven migration methodologies, realistic timelines, and clear accountability. They’ve managed hundreds of similar migrations and anticipate common challenges. Poor vendors promise quick implementations, underestimate complexity, and blame customers when timelines slip. Reference calls with companies who’ve completed similar migrations reveal vendor capabilities more accurately than sales promises.

Total migration timelines for comprehensive replacement of integrated architectures typically run 6-12 months for mid-sized distributors, depending on complexity and phasing approach. This seems daunting compared to theoretical “90-day implementations” that integrated point solutions promise—but which never account for integration development. The total elapsed time to fully operational new architecture often proves faster than best-of-breed implementation plus integration development.

ROI realization begins immediately after initial modules go live and accelerates as migration completes. Early phases deliver operational efficiency from reduced integration complexity. Later phases provide strategic capabilities that integrated architectures couldn’t support. Full ROI typically realizes within 18-24 months, driven by reduced IT overhead, improved operational efficiency, faster strategic initiative deployment, and business growth enabled by architectural flexibility.

The migration decision ultimately balances known pain of current integration complexity against perceived risk of platform change. Companies that acknowledge integration architecture constrains growth increasingly choose migration despite short-term disruption. The alternative—continuing indefinitely with architectures that limit strategic options and require escalating maintenance—proves more expensive and risky long-term than managed migration to modern unified platforms.

The Strategic Imperative of Architectural Clarity

Distribution companies that achieve operational excellence share a common pattern: architectural clarity that aligns system capabilities with business processes. This clarity proves impossible in integration-heavy architectures and naturally emerges from unified platforms designed specifically for distribution.

The operational manifestation is immediate. Staff understand how the system works because there’s one system to understand rather than eight partially integrated applications. Data integrity is trustworthy because there’s one version of truth rather than multiple systems requiring reconciliation. Reporting provides actual business intelligence because data exists in unified structures rather than requiring overnight ETL processes to assemble fragmented information.

The strategic impact compounds over time. New capabilities deploy rapidly because there’s no integration impact to assess. Market opportunities receive quick response because the platform accommodates change rather than constraining it. Growth accelerates because operations scale with transaction volumes rather than hitting architectural limits. Acquisitions integrate smoothly because the platform can absorb complexity rather than requiring heroic integration efforts.

The competitive advantage becomes sustainable. While competitors struggle with integration complexity, delayed strategic initiatives, and architectural constraints, companies on unified platforms focus on market execution, customer service, and operational excellence. The technology foundation enables business success rather than creating friction that slows growth.

The distribution industry has accepted integration complexity for too long, treating architectural fragmentation as inevitable rather than as a choice that fundamentally limits capability. Modern cloud-native unified platforms designed specifically for distribution eliminate the compromises that integration-heavy architectures impose. Real-time visibility, operational efficiency, strategic agility, and sustainable scalability don’t require heroic integration efforts—they result from architectural clarity that native functionality provides.

For distributors ready to escape integration complexity and implement platforms designed for operational clarity and strategic agility, Bizowie delivers the native functionality that modern distribution demands. Our cloud-native unified platform provides comprehensive capabilities across all distribution operations—inventory optimization, order management, warehouse operations, purchasing, customer management, financial operations, and analytics—without integration complexity or architectural compromise.

Schedule a demo to see how native functionality eliminates integration challenges while delivering capabilities that best-of-breed architectures cannot match, or explore how Bizowie’s unified platform approach provides the architectural clarity that sustainable growth requires.