Understanding Distribution Metrics: KPIs Every Distributor Should Track Daily

Ask a distribution company owner how business is going, and you’ll likely hear “pretty good” or “things are busy.” Press for specifics, and the conversation often turns vague. Revenue is up, but is profitability growing? Order volume is strong, but are you fulfilling efficiently? The warehouse feels busy, but is productivity actually improving?

Running a distribution business on gut feel and anecdotal evidence is like flying a plane without instruments. You might maintain altitude in good weather, but when conditions change or problems emerge, you have no way to identify issues early or correct course effectively.

The most successful distributors operate differently. They track specific, meaningful metrics daily that provide early warning of problems, highlight improvement opportunities, and enable data-driven decision making. These key performance indicators become the dashboard that guides strategic and operational choices, replacing guesswork with facts.

Understanding which metrics matter, how to calculate them, and most importantly how to act on the insights they provide separates thriving distributors from those merely surviving in increasingly competitive markets.

Why Daily Metrics Matter

The Lag Problem

Traditional financial reporting operates on monthly cycles. By the time you see last month’s financials, you’re already weeks into the new month. Problems that emerged early last month have been compounding for six weeks before you even see them in the numbers.

Daily metrics eliminate this lag by providing real-time visibility into operational performance, emerging trends before they become crises, immediate feedback on changes and initiatives, early identification of problems when intervention is still easy, and data supporting quick course corrections.

The faster you identify problems, the less damage they cause and the lower the cost to fix them.

Leading vs. Lagging Indicators

Financial results are lagging indicators reflecting what already happened. By the time profit declines, operational problems have been brewing for weeks or months.

Daily operational metrics provide leading indicators that predict future financial performance including order trends forecasting revenue, fill rates predicting customer satisfaction, inventory turns indicating working capital efficiency, picking accuracy affecting returns and customer issues, and receivables aging signaling future cash flow.

Tracking leading indicators lets you influence outcomes rather than just measuring results after the fact.

Creating Accountability Culture

When teams know their performance is measured daily, behavior changes. Metrics create accountability through clear performance expectations, visibility into individual and team contributions, objective basis for recognition and coaching, transparency reducing politics and favoritism, and continuous feedback accelerating improvement.

Organizations that track and share metrics daily develop performance cultures where everyone understands how their work contributes to business success.

Core Financial Metrics

Daily Revenue and Margin

While comprehensive financial statements come monthly, core revenue metrics should be tracked daily through total revenue by day and month-to-date, average order value, gross margin percentage and dollars, revenue by customer segment or category, and comparison to prior periods and budget.

These basic metrics help you understand whether you’re on track to hit revenue and profitability targets with weeks remaining to take corrective action rather than discovering shortfalls after the month closes.

Modern ERP systems calculate these metrics automatically from transaction data, providing real-time dashboards without manual effort.

Days Sales Outstanding (DSO)

DSO measures how quickly you collect receivables and represents critical working capital performance through formula: (Accounts Receivable / Total Credit Sales) × Number of Days, typical distribution target of 40 to 50 days, weekly or daily calculation showing trends, segmentation by customer or aging bucket, and correlation with cash flow and liquidity.

Rising DSO signals collection problems, changing customer mix, or relaxed credit discipline. Declining DSO indicates improving collections and working capital efficiency.

Track DSO trends rather than just absolute numbers to identify improvement or deterioration early.

Cash Position and Runway

Cash is the lifeblood of distribution operations. Daily cash tracking includes current cash balance, weekly cash flow projection, days cash on hand at current burn rate, upcoming significant cash needs, and variance from budget or forecast.

Understanding your cash position daily prevents surprises, enables proactive management of payment timing, identifies financing needs before crises, and provides confidence to invest in growth opportunities.

Many distribution companies have failed despite being “profitable” on paper because they ran out of cash. Daily cash visibility prevents this fate.

Inventory Performance Metrics

Inventory Turnover Rate

Inventory represents your largest working capital investment. Tracking turnover daily or weekly reveals how efficiently you’re managing this investment through formula: Cost of Goods Sold / Average Inventory Value, calculation by category and product line, comparison to industry benchmarks, trend analysis over time, and identification of slow-moving inventory.

Declining turnover indicates excess inventory building up, obsolescence risk growing, or working capital being wasted. Improving turnover shows better demand forecasting and inventory optimization.

Target turnover rates vary by industry and product category, but most distributors should achieve 6 to 12 turns annually. Understanding your current performance enables setting improvement goals.

Fill Rate and Stockout Frequency

Fill rate measures your ability to fulfill customer orders completely from available inventory through percentage of order lines shipped complete, percentage of orders shipped complete without backorders, frequency of stockouts by SKU, impact of stockouts on revenue, and customer satisfaction implications.

High fill rates indicate good inventory availability and forecasting. Declining fill rates signal inventory problems developing before they appear in financial metrics.

Balancing fill rate with inventory investment represents one of distribution’s core challenges. The right metrics help you optimize this tradeoff.

Slow-Moving and Obsolete Inventory

Not all inventory is created equal. Track the quality of your inventory investment through percentage of inventory over 90, 180, and 365 days old, dollar value tied up in slow movers, obsolescence reserve as percentage of inventory, disposal and write-off trends, and inventory by category and velocity.

Slow-moving inventory represents cash trapped in assets that may never convert to sales. Identifying and addressing these problems protects working capital and warehouse space.

Set clear policies for managing aging inventory including promotional pricing, return to suppliers, or liquidation before value erodes further.

Inventory Accuracy

You cannot manage what you cannot measure accurately. Regular tracking of inventory accuracy through cycle count performance and variances, physical inventory accuracy percentage, root cause analysis of discrepancies, shrinkage and loss rates, and system inventory versus physical reality.

Poor inventory accuracy undermines every other inventory metric and decision. If system data is wrong, you’ll make bad decisions no matter how sophisticated your analytics.

Target 98 percent or better inventory accuracy through regular cycle counting, root cause analysis, and process improvements addressing sources of inaccuracy.

Order Fulfillment Metrics

Order Cycle Time

How long does it take from order receipt to shipment? Track cycle time to understand responsiveness including average hours from order to shipment, percentage shipped same day or next day, cycle time by order type or customer segment, bottlenecks in the fulfillment process, and trend analysis showing improvement or deterioration.

Faster cycle times improve customer satisfaction, reduce working capital tied up in orders, enable higher throughput through your operation, and provide competitive differentiation in markets where speed matters.

Identify your current baseline, then systematically address bottlenecks preventing faster fulfillment.

Order Accuracy and Error Rates

Fulfillment errors damage customer relationships and increase costs through picking accuracy percentage, shipping errors requiring correction, returns due to fulfillment mistakes, cost of errors including freight and labor, and root cause analysis driving improvement.

Every fulfillment error costs money directly through freight, labor, and potentially lost product, plus damages customer trust and satisfaction.

Target 99.5 percent or better picking accuracy through process optimization, training, technology enablement, and quality controls.

Lines Picked Per Hour

Labor productivity in the warehouse directly impacts profitability through lines or units picked per labor hour, productivity by picker and shift, impact of process changes on productivity, comparison to industry standards, and correlation with order mix and complexity.

Tracking productivity enables setting expectations, identifying top performers for recognition, coaching lower performers, and measuring impact of improvement initiatives.

Typical distribution operations achieve 80 to 150 lines per hour depending on product characteristics and warehouse configuration. Know your baseline and drive systematic improvement.

On-Time Shipment Performance

Meeting promised delivery dates drives customer satisfaction and retention through percentage of orders shipped by promised date, reasons for late shipments, impact on customer satisfaction, carrier performance contributing to delays, and trends over time.

Late shipments frustrate customers, generate service calls, and risk losing business to more reliable competitors. This metric highlights whether you’re meeting customer expectations consistently.

Customer Metrics

Customer Acquisition and Retention

Track how your customer base evolves through new customers added in period, customer churn rate and reasons, revenue from new versus existing customers, customer lifetime value trends, and growth rates by customer segment.

Healthy distribution businesses maintain balance between acquiring new customers and growing existing relationships. These metrics show whether you’re building or eroding your customer base.

Losing customers is often invisible until revenue declines. Daily tracking of customer activity reveals relationships at risk while you can still save them.

Revenue Concentration

Understanding revenue concentration highlights risk in your customer portfolio through percentage of revenue from top 10, 20, and 50 customers, customer dependency and concentration risk, trends showing increasing or decreasing concentration, and diversification efforts and results.

Excessive concentration on few customers creates vulnerability if those relationships change. Balanced portfolios provide more stable, lower-risk revenue streams.

If your top customer represents more than 20 percent of revenue, you have concentration risk requiring active mitigation through diversification efforts.

Customer Profitability

Not all revenue is equally profitable. Track profitability by customer including gross margin by customer and segment, cost to serve different customers, total profitability after all costs, identification of unprofitable relationships, and actions to improve customer profitability mix.

Some high-volume customers may generate low or negative profitability after accounting for service costs, returns, and special handling. Understanding true customer profitability enables strategic decisions about pricing, service levels, and relationship investments.

Operational Efficiency Metrics

Warehouse Space Utilization

Warehouse space represents significant cost. Track utilization to optimize capacity through percentage of locations occupied, inventory cubic feet versus capacity, identification of underutilized areas, seasonal patterns in space needs, and ROI of expansion versus optimization.

Poor space utilization may indicate excess inventory, inefficient layouts, or opportunity to avoid expansion investments through better management.

Labor as Percentage of Revenue

Labor represents one of your largest controllable costs through total labor cost as percentage of revenue, labor by function including warehouse, customer service, and sales, productivity trends over time, impact of volume changes on labor efficiency, and comparison to industry benchmarks.

Rising labor percentage signals efficiency problems or margin erosion. Declining percentage shows improving productivity and scaling.

Typical distribution labor runs 10 to 20 percent of revenue depending on service levels and automation. Track your performance against relevant benchmarks.

Perfect Order Rate

The perfect order metric combines multiple dimensions of fulfillment excellence through orders delivered complete, accurate, on time, and undamaged, comprehensive measure of customer experience, identification of failure modes and root causes, and trend showing improvement or decline in overall execution.

Perfect order rate provides single metric reflecting total fulfillment performance. Target 95 percent or better through systematic process improvement.

Technology and Systems Metrics

System Uptime and Performance

Your operations depend on technology working reliably through ERP system uptime and availability, transaction processing speed and responsiveness, mobile device and scanner performance, integration reliability between systems, and help desk tickets and resolution time.

System problems disrupt operations immediately. Daily monitoring ensures technology supports rather than constrains business performance.

Data Quality and Accuracy

Business intelligence depends on accurate data through master data accuracy and completeness, transaction error rates, duplicate records and data integrity issues, data synchronization across systems, and remediation efforts and improvement trends.

Poor data quality undermines decision-making regardless of analytics sophistication. Regular measurement and improvement of data quality pays continuous dividends.

Creating Your Metrics Dashboard

Selecting the Right Metrics

Not every possible metric deserves daily attention. Choose metrics that align with strategic priorities, provide actionable insights, lead rather than lag performance, can be influenced by your actions, and balance across different business dimensions.

Most organizations should track 15 to 25 daily metrics covering financial performance, inventory management, fulfillment excellence, customer health, and operational efficiency.

Avoid metric overload that creates noise rather than insight. Focus on the vital few that truly drive your business.

Visualization and Accessibility

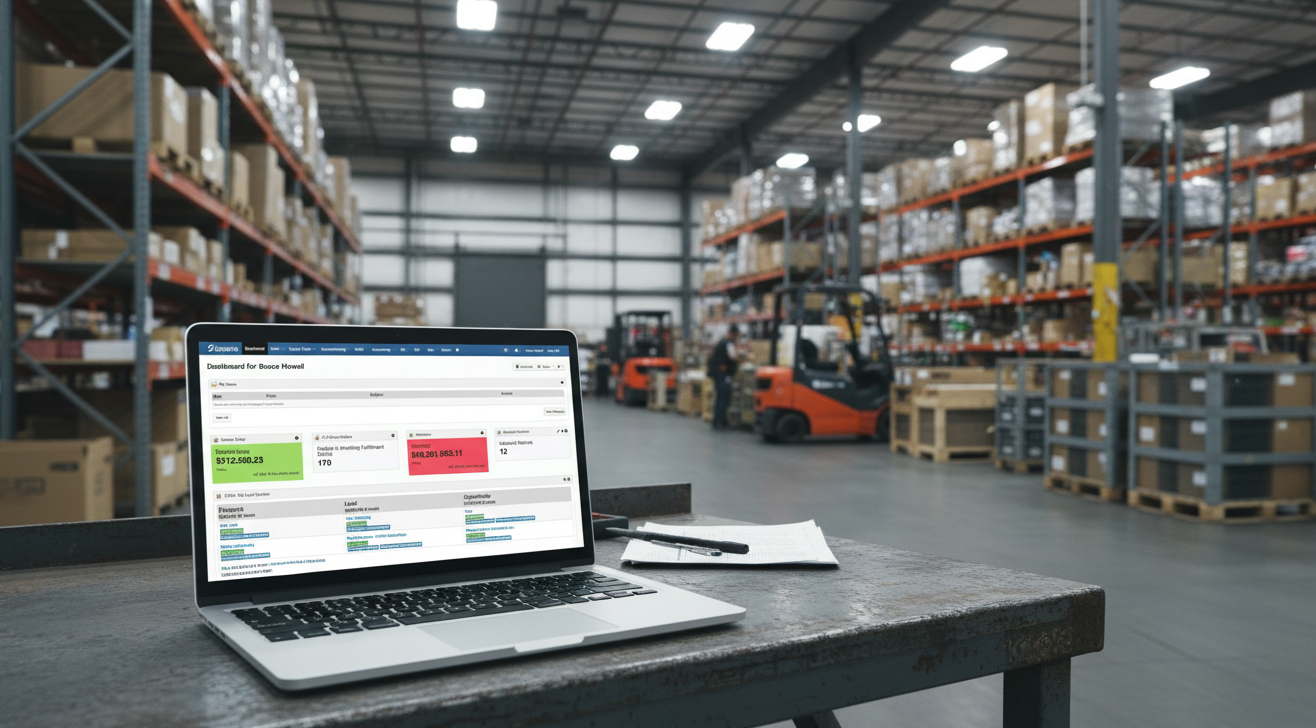

Metrics only create value when people see and use them. Effective metric programs include dashboards showing current performance and trends, mobile access enabling anywhere viewing, role-based views showing relevant metrics, automated alerts for metrics outside targets, and easy drill-down from summary to detail.

Modern ERP platforms provide configurable dashboards pulling real-time data without manual reporting effort, making daily metrics sustainable rather than burdensome.

Establishing Targets and Accountability

Metrics without targets provide information but not motivation. Establish clear targets through baseline measurement of current performance, research of industry benchmarks, stretch goals driving improvement, individual and team accountability, and regular review and recognition.

When metrics tie to accountability and recognition, they drive behavior change and performance improvement rather than just providing interesting information.

Acting on Metric Insights

Daily Operational Reviews

Create rituals around metric review through daily huddles reviewing key metrics, quick problem identification and action assignment, celebration of wins and achievement, escalation of issues requiring attention, and documentation of patterns and trends.

These brief daily reviews keep teams aligned, surface issues quickly, and maintain focus on continuous improvement.

Trend Analysis and Pattern Recognition

Single-day metrics may fluctuate randomly. Watch for patterns including multi-day trends suggesting systematic changes, seasonal patterns requiring anticipation, correlation between different metrics, leading indicators predicting future performance, and anomalies warranting investigation.

Sophisticated metric programs evolve from simple reporting to predictive analytics that help you get ahead of problems rather than just measuring them.

Continuous Improvement Process

Metrics should drive action and improvement through root cause analysis when metrics deteriorate, experimentation with improvement initiatives, measurement of initiative impact, adoption of successful changes, and elimination of ineffective efforts.

The goal isn’t just tracking metrics but systematically improving them over time through data-driven process enhancement.

The Bizowie Advantage for Metrics Management

Bizowie’s cloud ERP platform provides comprehensive, real-time visibility into all the metrics that matter for distribution operations. Our integrated system delivers automated calculation of key performance indicators, configurable dashboards showing critical metrics, real-time data without manual reporting effort, drill-down from summary to detailed transactions, mobile access to metrics anywhere, and role-based views for different users.

With Bizowie, you don’t need separate business intelligence tools or manual spreadsheet reporting to track daily metrics. The platform automatically captures transaction data and presents it in actionable dashboards that guide daily operations and strategic decisions.

Our all-in-one approach means metrics reflect complete, accurate data across inventory, orders, customers, and financials without reconciliation issues common in fragmented systems. The clarity and control Bizowie delivers includes the metrics visibility every distributor needs to compete effectively.

Bizowie transforms metrics from burdensome reporting exercises into seamless, real-time insight that becomes central to how you run your business daily.

Getting Started with Daily Metrics

Implementation Roadmap

Build your metrics program systematically through selection of vital few metrics aligned with strategy, establishment of baseline measurements, configuration of automated reporting and dashboards, training teams on metrics and targets, launch of daily review rituals, and continuous refinement based on experience.

Don’t try to implement everything simultaneously. Start with core metrics providing immediate value, then expand as capabilities mature.

Common Implementation Pitfalls

Avoid mistakes that derail metrics initiatives including tracking too many metrics creating noise, measuring without taking action on insights, establishing unrealistic targets that demotivate, relying on manual reporting that becomes unsustainable, creating metrics that people cannot influence, and using metrics to punish rather than develop people.

Metrics should enable better decisions and drive improvement, not become bureaucratic exercises people resent.

Building Metrics Culture

Sustainable metrics programs require cultural support through leadership modeling attention to metrics, transparency in sharing performance data, balanced celebration and accountability, focus on improvement not blame, investment in systems enabling easy measurement, and recognition that metrics evolve as business needs change.

The most successful distribution companies make metrics central to how they operate, with data-driven decision making becoming second nature rather than special initiative.

Conclusion

Distribution businesses generate vast amounts of data through thousands of daily transactions. The difference between successful companies and struggling ones often comes down to whether they transform this data into actionable insights guiding daily decisions.

Daily metrics provide the real-time dashboard every distributor needs to identify problems early, capitalize on opportunities quickly, hold teams accountable for performance, make decisions based on facts rather than intuition, and drive continuous improvement across operations.

The metrics that matter span financial performance, inventory management, fulfillment excellence, customer health, and operational efficiency. Together they provide comprehensive visibility into business health and operational effectiveness.

Modern cloud ERP platforms like Bizowie make daily metrics practical and sustainable by automating data capture, calculation, and presentation without requiring extensive manual reporting effort. When metrics become seamless byproducts of normal operations rather than special projects, they become sustainable parts of how you run your business.

The distribution companies thriving in competitive markets operate on data, not guesses. They know their numbers daily, identify trends early, and make quick course corrections when metrics signal problems developing.

The question isn’t whether daily metrics matter. It’s whether you’re measuring the right things, seeing the insights clearly, and taking action to continuously improve performance.

Stop flying blind. Build the metrics dashboard your distribution business needs to compete effectively and grow profitably.